Can Robinhood survive The FTX mess?

Today's Fun Fact

The stock market is more than 400 years old.

Here's what you need to know before the US markets open.

What to expect in today's market 🕒

Alibaba Group Holding Ltd. (BABA)

Macy's Inc. Earnings (M)

Kohl's Corporation Earnings (KSS)

Applied Materials Inc. Earnings (AMAT)

Palo Alto Networks Inc. Earnings (PANW)

Ross Stores Inc. Earnings (ROST)

BJ's Wholesale Club Holdings Inc. Earnings (BJ)

Williams-Sonoma Inc. Earnings (WSM)

12:30 PM GMT: Initial Jobless Claims

Robinhood: Hope To Despair?

Robinhood Markets Inc.’s (HOOD) results may want you to believe things are looking better for them after a disastrous year. However, a crypto-billionaire who thought things were prime for a rebound at the company now has the potential to become its kryptonite. Can Robinhood survive this mess?

A Subject For Debate

Robinhood earlier wanted to grow towards profitability. Now, it aims to shrink towards profitability as some of its core metrics remain below their peak.

Most of Robinhood's revenue comes from trading volumes. It sends orders to high-speed trading firms in exchange for cash, known as Payment for Order Flow (PFOF). PFOF at the dozen largest US brokerages declined 13% in Q3. For Robinhood, PFOF from stocks and options trading declined by nearly a third.

The platform has struggled to retain customers after it restricted the trading of GameStop after the entire meme-stock-mania unraveled. Seasoned retail investors also doubted the platform's claims of “democratizing finance for all.”

For a community that relies more on hearsay than pure research, it is never a good endorsement of your capabilities when legendary investors like Charlie Munger trash you in public. The nonagenarian compared it to “racetrack betting” and called it wildly speculative.

By then, shares of Robinhood were down in the dumps, having corrected over 90% from their peak. But as one man's trash is another man's treasure, Robinhood found an unlikely source to reignite interest in the stock.

Shares jumped over 25% in a single session in May after Sam Bankman-Fried, the billionaire founder of cryptocurrency exchange FTX disclosed a 7.6% stake in the company worth $650M, making him one of the largest shareholders.

Bankman-Fried quickly clarified that he made a move only because he found it an attractive investment and that he didn’t plan to do anything that altered the current control structures in the company.

One Step Forward, Two Steps Back

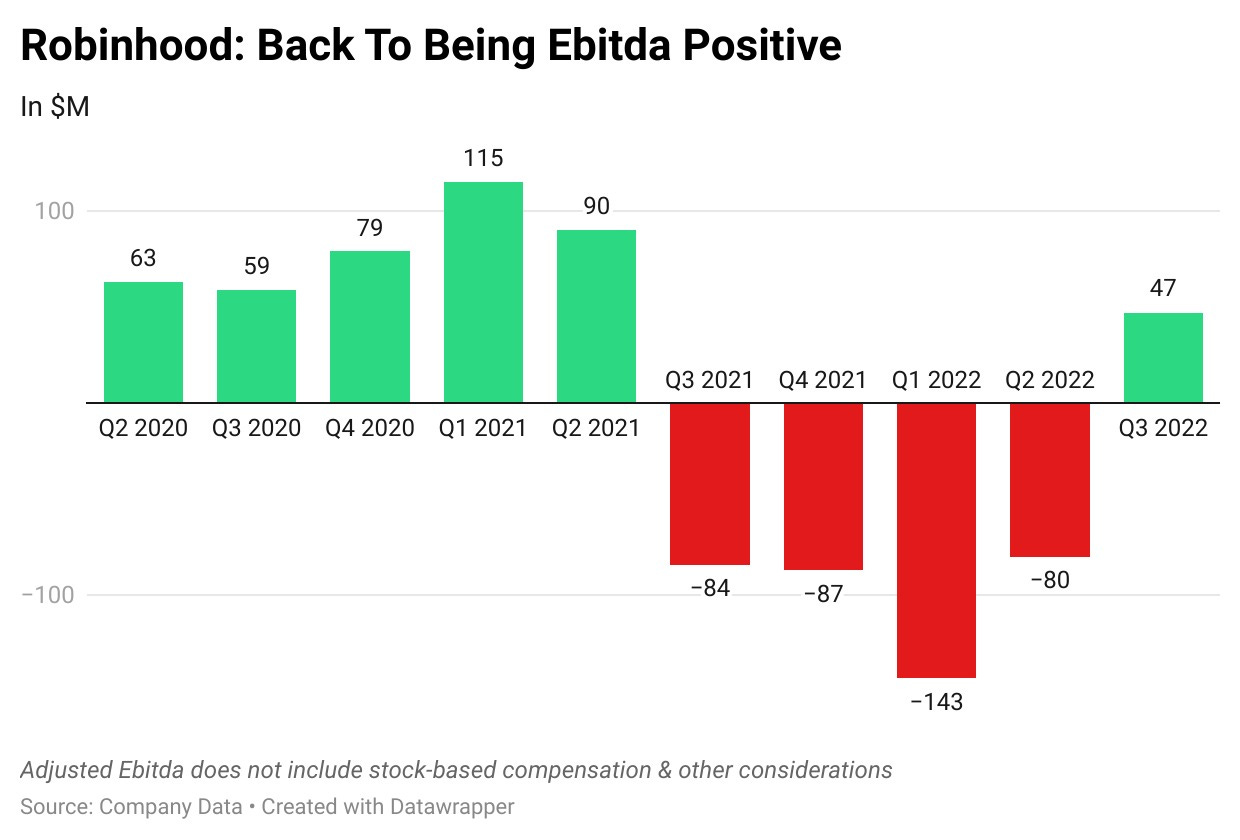

However, not all is gloom for Robinhood. Some metrics, even though not tied to its core business, some metrics are improving. For example, it turned adjusted Ebitda positive a quarter earlier than planned. On a net basis, even as it remains loss-making, they substantially narrowed from last year.

Key Highlights From Q3:

Revenue: $361M Vs $355M expected

Loss Per Share: $0.20 Vs $0.31 expected

Net Loss: $175M Vs $1.32B year-on-year

Robinhood’s revenue fell 1% in Q3, and the drop was cushioned by its Net Interest Revenue, which doubled from last year to $128M. The company claims to have interest-generating assets worth $17B. Net Interest Revenue will likely be better by $25M in the current quarter compared to Q3.

The company’s margin trading business helped cut losses as interest rates rose. The annual margin interest rates have risen to 5.75% for Robinhood's gold customers and 9.75% for non-gold customers. Robinhood Gold is a subscription service where users get access to premium features.

Here are some other highlights from Robinhood's quarterly earnings:

Adjusted Ebitda: $47M, which does not include stock-based compensation, impairments, and restructuring charges

Active Monthly Users: 12.2M Vs 13.7M expected

Transaction revenue: $208M Vs $211.5M expected

Average Revenue Per User: $63 from $65 last year and $102 in Q3 2020

Assets Under Custody: $65M from $64.6M in Q2 and $95M last year

Robinhood has also drastically cut down on expenses. It laid off 9% of its workforce in the second quarter and 25% in the third. Overall expenses were down nearly 70% in Q3 to $535M.

Just as things may have optically attempted to look better for the company, Sam Bankman-Fried set the cat among the pigeons again. His crypto-exchange FTX has filed for bankruptcy, he has stepped down as CEO, and lost nearly $1B of his net worth in a single day.

The FTX fiasco also sparked a sell-off in Robinhood's shares owing to SBF's stake in the company. It remains unclear what happens to that stake, which is now worth $470M from the initial value of $650M.

Robinhood claims its business as usual at the company, as even though SBF owns a stake, they have no exposure to FTX or its related entities. In fact, the management claims that the FTX saga has been a blessing in disguise for the company as it witnessed a surge in crypto trading volumes and saw its best-ever two-day crypto inflows. The amount of inflows is unclear.

Love it, hate it, but you can’t keep it out of action - that’s Robinhood for you. Everybody has an opinion on the company - some kind, some not so. It is still losing customers, which is a cause of concern even as some metrics appear to recover. This Robinhood has done anything but return meaningful gains to its shareholders. The company could only hope that the tide turns, with or without SBF!

Market Reaction

HOOD ended at $9.32, down 8.18%.

Newsworthy 📰

Another Warning: Target warns of soft holiday quarter as profit tumbles and sales slow (TGT -13.06%)

No Takers: Micron to cut production of memory chips citing softening market demand (MU -6.70%)

What Inflation?: Lowe's says it is not seeing negative impact of inflation as sales, profit top expectations (LOW +2.97%)

What Next?

Subscribe to the Trove YouTube Channel

Join the Trove Telegram Community

Rate us on the Playstore or Appstore

Disclaimer: The email content is prepared and provided by Winvesta India Technologies Ltd. for informational and educational purposes only and is not meant to represent trade or investment recommendations. Remember capital is at risk. Terms & Conditions apply.